Soaring Inflation Rates Worry Teens

How can teens manage their money through this uncertain time?

As inflation rises more and more every day, teens have to learn how to manage their money.

October 31, 2022

As COVID-19’s restrictions are lifted, more people are getting out of their houses and spending money again. As people start to break out of their bubbles, companies cannot keep up with the production needed to satisfy customers, so prices are rising more and more to keep up with the supply needed.

Though this change affects everyone in the economy, it is especially frightening for teens who are now stepping out into the world of spending. While teens are starting to work, they generally get paid less than other workers. Many teens run into problems with how to pay for what they need while inflation is so high.

“I may have those skills of budgeting, but things will definitely change and get really hard once I’m on my own and paying for my own insurance, phone, car, groceries, home, etc. It’s terrifying, honestly; everything costs way more than it did,” Sara Pfitzer, junior at Dakota Ridge, said.

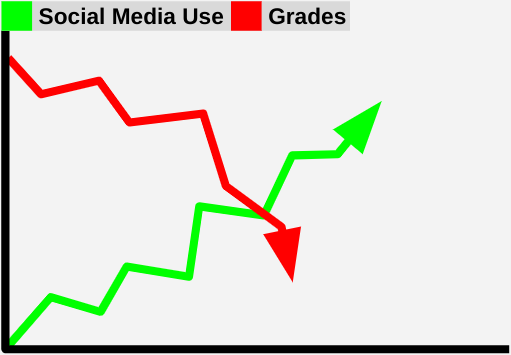

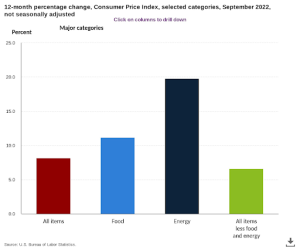

Inflation rates have gone up 8.2% since September 2021, according to the U.S Labor Department. That translates to something that had once cost $100 dollars in 2021 now costs $108.20 in 2022. This is a substantial increase, leaving many unsure of how to pay for what they need.

What teens most need is for more people to guide them through this strenuous time in life. Do schools do enough for these students?

“I’m definitely not educated enough on finances, and I want to be, but I don’t know what information on Google is actually helpful or would hurt me in the long run,” Pfitzer said.

Paul Luna, an Economics teacher, has been taking steps to help his students understand what is happening.

“We are talking about something that they are dealing with because they have to buy gas, and they have to pay for food, and they are seeing inflation impact their daily life,” Luna said.

Luckily for Luna’s students, they go through stocks daily and watch as inflation increases, all while aware of the problem hitting our economy. But not all students have this advantage. Some have been fortunate to have parents who guide them through, but there are still many students who don’t know how to deal with the current inflation situation.

“I’m lucky enough to have a parent who makes a good amount of money and taught me how to budget/save money when I was little, so I have that slight step up,” Pfitzer said. “But I know some people weren’t given that situation, and I feel for them with the current economy.”

One of the main things that affects teens are the gas prices. As many teens have started driving and are responsible for paying for their own gas, it’s often difficult to learn how to budget for those expenses.

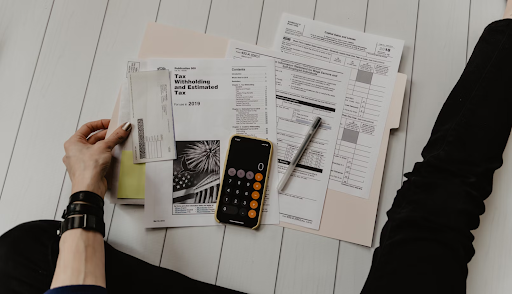

When budgeting, it is important to keep in mind the 50-30-20 rule. The rule says that one should spend 50% of income on needs and must-haves, 20% should go into savings, and 30% can go to anything else.

“We talk about the importance of having a budget and weighing your costs, needs cost vs. wants costs. We talk about personal finance and budgeting too. I help them understand having balance in the way you live your life and not being too debt heavy,” Luna said.

One big question is, is there a potential change to inflation? It’s hard to completely predict what will happen, but Luna points out that the recovery rate on this inflation is around 18 months, so we will still be struggling with this problem in the future.

“Some of it has to do with supply chain issues, and fuel costs that maybe shouldn’t be high, but are high,” Luna said, “Some of it has to do with people, with these high inflationary numbers, holding onto their money and not spending as much and pulling the economy down.”

As we are living through inflation, it is essential to focus on teaching teens how to budget and make their way through it.

“The best advice I was always given is to pay yourself first, whenever you get a paycheck, you pay yourself first. What that means is to put some of your own money into savings — you pay yourself before you pay other people. Spending or shopping, you want to make sure you put a little bit of your money away first to save up,” Kayla Northrup, a local employee at Wells Fargo Bank, said. “Depending on what your goals are or what you’re saving for, you can help bring that to you by paying yourself first. I always pay myself at least 25% of my paycheck, which goes into savings, and then the rest I allocate out to bills, etc.”

To provide help for teens, some apps like Mint, which tracks your expenses and puts them in budgeting categories, and GoodBudget, that helps plan for your finances, provide assistance for those who need budgeting help.

“I hope that everyone can somehow learn finances because it’s definitely something that would help any kid,” Pfitzer said. “Schools really should teach it; I know people would actually pay attention then and get a better understanding of how the government functions.”

Follow this link to find more apps to help you with your budgeting needs! The 8 Best Budget Apps for 2022 – NerdWallet